Webinar Takeaways: How Blockchain-backed Smart Contracts are Generating Trust, Accuracy, Efficiency and Savings Around ESG Reporting

Environmental, social and corporate governance (ESG) reporting can be a difficult and confusing task for companies that are beginning to collect and calculate this data, but according to Data Gumbo and ESG Lynk, blockchain-backed smart contracts can help streamline this process, create transparency, provide accuracy and save on both time and cost.

During a recent webinar hosted by the National Waste & Recycling Association (NWRA), Michael Matthews, senior vice president of Data Gumbo; Jennifer Sadenwater, managing director of ESG Lynk; Jim Riley, chief counsel and senior vice president of government affairs of NWRA; and Maxine Aitkenhead, director of business development for Data Gumbo, discussed how waste and recycling companies can use these smart contracts to make the ESG reporting process simpler and create trust across a network of interconnected sources.

“Organizations often struggle with ESG reporting because of the wide variety of data sources both inside and outside the company,” said Matthews. “They need to identify how they will treat and calculate that data, and a smart contract can help with that.”

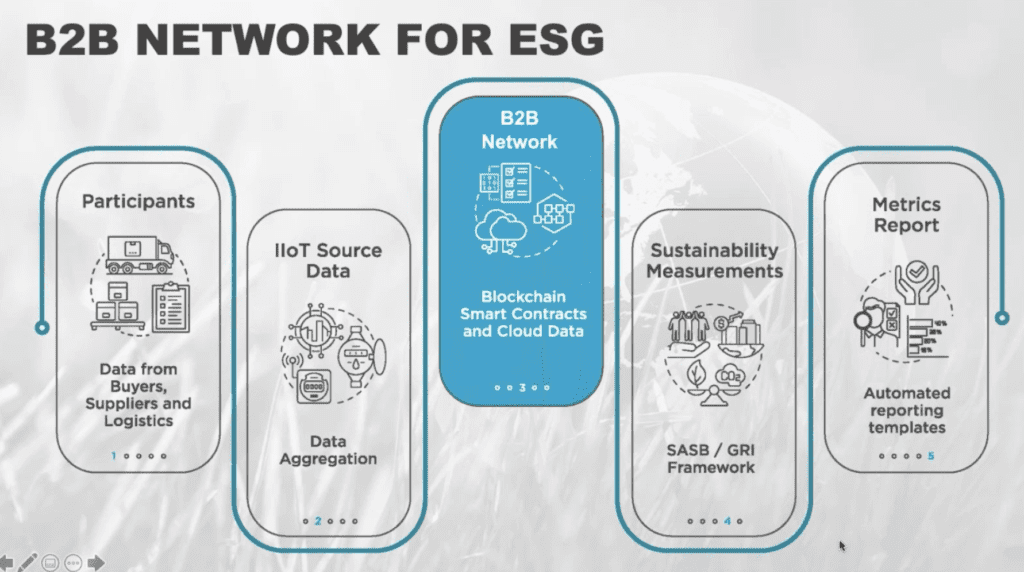

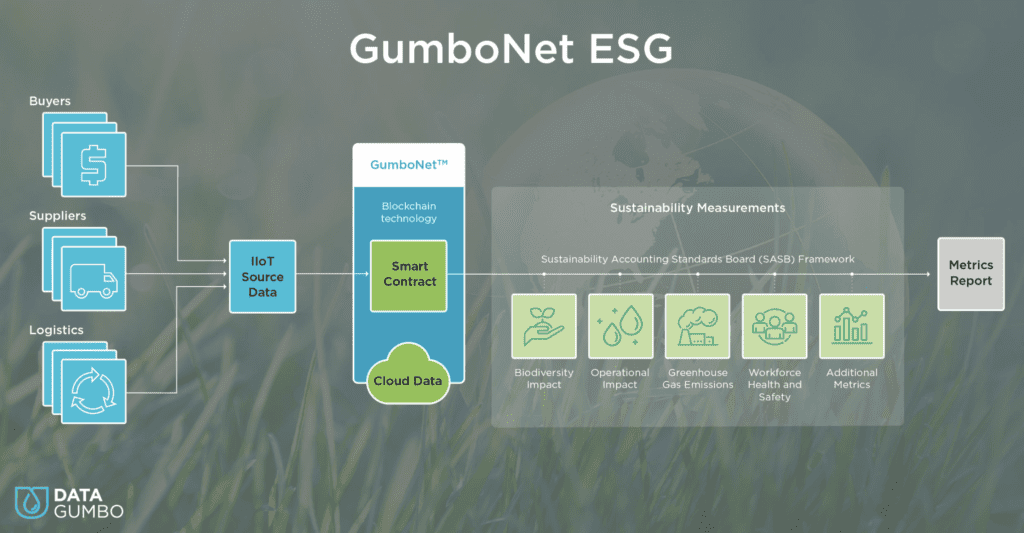

This process is further explained in the graphic below. First, companies collect data from a wide range of counterparties in their value chain, such as field data around operations. Second, that data feeds into a smart contract network, such as Data Gumbo’s GumboNet ESG, where an ESG-focused smart contract reports the data in a way that’s repeatable, auditable and transparent. Lastly, companies take those results and create accurate reports based on recognized standards to provide to a variety of stakeholders.

“When you’re starting this process, it’s important to know where your baseline is because you need to be able to point to specific activities, such as decarbonization activities and the impact on your emissions, so you can achieve a goal such as a net zero footprint,” explained Matthews.

Both Data Gumbo and ESG Lynk suggest using the Sustainability Accounting Standards Board (SASB) framework to identify what data types you want to measure because the standards are industry specific and likely include data you’re already collecting and tracking. GumboNet ESG actually uses this framework to produce its reports for customers.

“Some companies don’t know all of their data sources, so we work with them to footnote the process of how they collect data and to identify ways to implement new procedures so they can ensure they include 100 percent of their data sources in the future.

“Not tracking and reporting on your ESG metrics can be a missed opportunity because the reporting process can help identify strengths and weaknesses in your processes and often lead to a shift in your strategic direction. In addition, as investors look toward ESG performance as an indicator of long-term viability, not tracking and reporting on your ESG efforts can also be a cause of missed capital,” said Sadenwater.

While ESG reporting is not currently regulated in the U.S., the U.S. Securities and Exchange Commission is working on climate reporting mandates, and ESG reporting can be used to provide a look into your company in regard to things like carbon footprint. Additionally, beyond financial metrics, it can help outline how you’re treating staff and customers, how you’re being mindful of the environment through your operations and how your safety record is changing over time.

“ESG reporting isn’t a leap; it’s a best practice,” stated Sadenwater. “It’s important to tell your company’s story so you can share it with your stakeholders. It’s also just as important to get a handle on your baseline metrics and gain comfort over your ESG data collection processes before reporting becomes officially regulated.”

Interested in learning more? Listen to a recording of the webinar here.